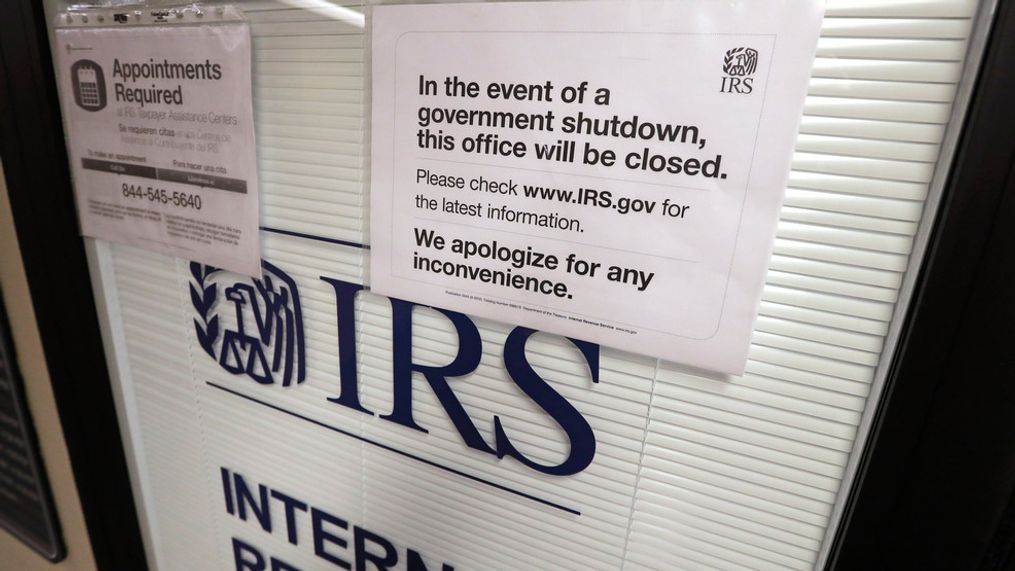

The Internal Revenue Service (IRS) has confirmed that “most” of its operations are closed due to the ongoing federal government shutdown, with an IRS-wide furlough beginning on October 8, 2025, for all employees except those designated as exempt or excepted. The agency stated that non-exempt and non-exceptional staff are placed in a non-pay and non-duty status until further notice, though they are instructed to report for their next tour of duty. Employees have up to four hours to finalize work requirements and receive formal furlough notifications.

The IRS’s updated contingency plans reveal that 53% of its workforce will remain operational as the shutdown enters its second week, with most of these employees working in public-facing taxpayer service roles. Initially, the agency kept all staff on duty for the first five business days of the shutdown but did not outline protocols for extended funding lapses beyond October 7.

A union representative criticized the situation, stating that taxpayers face heightened difficulties accessing assistance as they prepare to file extension returns due next week. The spokesperson highlighted growing frustration among workers and a rising backlog of unresolved tasks. They urged the Trump administration and Congress to resolve the shutdown to restore essential services.

The notice to employees indicates that furloughed workers and those remaining on duty will receive back pay once the shutdown ends, contradicting earlier warnings from the Republican administration about uncertain compensation for affected federal workers. Earlier this year, the IRS implemented mass layoffs under the Department of Government Efficiency, reducing its workforce from approximately 100,000 in late 2024 to around 75,000 currently.